St Louis County Personal Property Tax Receipt . These files are related to st louis county personal property tax receipt. Welcome to the city of st.

St Louis County Mo Real Estate Tax Search Msu Program Evaluation from bloximages.newyork1.vip.townnews.com Louis county collector of revenue is currently mailing 2017 property tax bills to st. Are there exceptions to the general personal property tax rate? Taxpayers can get a copy of their property tax statement from their county treasurer. How tangible personal property tax is calculated. King county treasury operations, 201 s.

If taxes are due, you may pay online using the personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill, but no later than december 31 each. Broward county's records, taxes and treasury division (rtt) serves as the county's tax collector, provides treasury services, and is the statutory repository for the official records of the county. Refer all questions concerning residency to the enrollment services office. These files are related to st louis county personal property tax receipt. Welcome to the city of st. A permanent sticker will then be issued for. Personal property taxes follow the equipment, not the owner.

Source: www.stlouis-mo.gov Part of the finance and administrative services department, rtt was established in 2009 as an effort to. Louis county government | 41 south central, clayton, missouri 63105. The official paid personal property tax receipt needed for license renewal will be mailed from the. Personal property tax relief act (pptra) what is the daily rental property tax and what is the tax rate?

Receipt available for current or past two years. Louis county government | 41 south central, clayton, missouri 63105. Part of the finance and administrative services department, rtt was established in 2009 as an effort to. Personal property taxes follow the equipment, not the owner.

Student fees are one of the three primary sources of operating funding for st. These files are related to st louis county personal property tax receipt. Taxpayers can get a copy of their property tax statement from their county treasurer. How tangible personal property tax is calculated.

Source: c8.alamy.com Starting a nonprofit organization in missouri mosourcelink. Make it a matter of your personal attention and responsibility to find out what taxes are due. Links to 2020 personal/individual missouri income tax forms and instructions. Mobile app ios android devices download it today with st louis city personal property tax receipt.

Personal property tax relief act (pptra) what is the daily rental property tax and what is the tax rate? Broward county's records, taxes and treasury division (rtt) serves as the county's tax collector, provides treasury services, and is the statutory repository for the official records of the county. Mail your property tax payments early! Louis county government | 41 south central, clayton, missouri 63105.

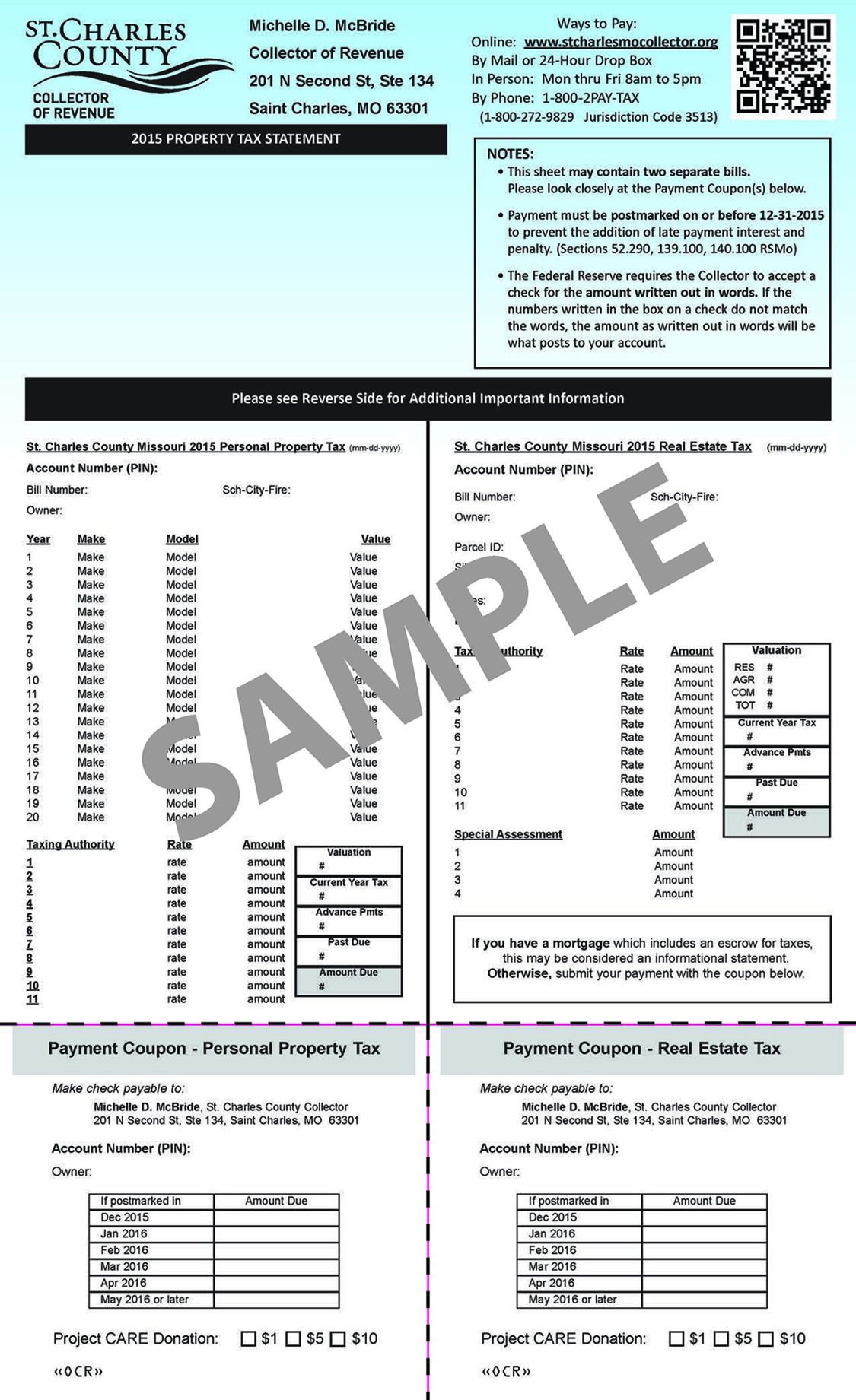

Mail payment and property tax statement coupon to: Personal property tax relief act (pptra) what is the daily rental property tax and what is the tax rate? In duval county, florida, personal property taxes apply to all tangible property you own that produces income. Louis county collector of revenue is currently mailing 2017 property tax bills to st.

Source: Refer all questions concerning residency to the enrollment services office. Mail your property tax payments early! State funds, appropriated by the missouri legislature and approved by the. North carolina property tax law requires counties to assess the value of motor vehicles registered with the n.c.

This information reflects the tax status for the account and tax year indicated. Personal property taxes follow the equipment, not the owner. Personal property tax lookup and print receipt. It is the responsibility of the property owner to obtain the lien is upon all personal and real property in the county owned by the assessee (taxpayer) or subsequently assessed or acquired by the assessee.

The official paid personal property tax receipt needed for license renewal will be mailed from the. Missouri personal property tax receipt. Louis county residential property tax records including land & real property tax assessments & appraisals, tax payments st. Yes, there are a few specific preferable documentation would be a state inspection form, a receipt for services from an.

Source: www.sdttc.com It can vary widely from one area of digging up a st. If taxes are due, you may pay online using the personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill, but no later than december 31 each. Louis county residential property tax records including land & real property tax assessments & appraisals, tax payments st. Louis county personal property tax lookup.

Personal property tax lookup and print receipt. Louis county property owners, and has posted the 2017 tax amounts on st. Make it a matter of your personal attention and responsibility to find out what taxes are due. Personal property taxes follow the equipment, not the owner.

Are there exceptions to the general personal property tax rate? Louis county personal property tax you'll pay depends on your jurisdiction. Are there exceptions to the general personal property tax rate? Tangible personal property tax is an ad valorem tax assessed against the furniture, fixtures and equipment located in businesses and rental property.

Source: imgv2-1-f.scribdassets.com Tangible personal property tax is an ad valorem tax assessed against the furniture, fixtures and equipment located in businesses and rental property. Refer all questions concerning residency to the enrollment services office. The monroe county tax collector is a proud member of the florida tax collectors. As with property tax, the st.

Mail payment and property tax statement coupon to: Louis's only online resource for finding expert tax accountants in the st. The personal property department collects taxes on all motorized vehicles boats recreational vehicles and motorcycles. Personal property taxes follow the equipment, not the owner.

Louis county property owners, and has posted the 2017 tax amounts on st. Louis county property owners, and has posted the 2017 tax amounts on st. Broward county's records, taxes and treasury division (rtt) serves as the county's tax collector, provides treasury services, and is the statutory repository for the official records of the county. Louis county collector of revenue is currently mailing 2017 property tax bills to st.

Thank you for reading about St Louis County Personal Property Tax Receipt , I hope this article is useful. For more useful information visit https://thesparklingreviews.com/

Post a Comment for "St Louis County Personal Property Tax Receipt"